When Does The Big Beautiful Bill Go Into Effect

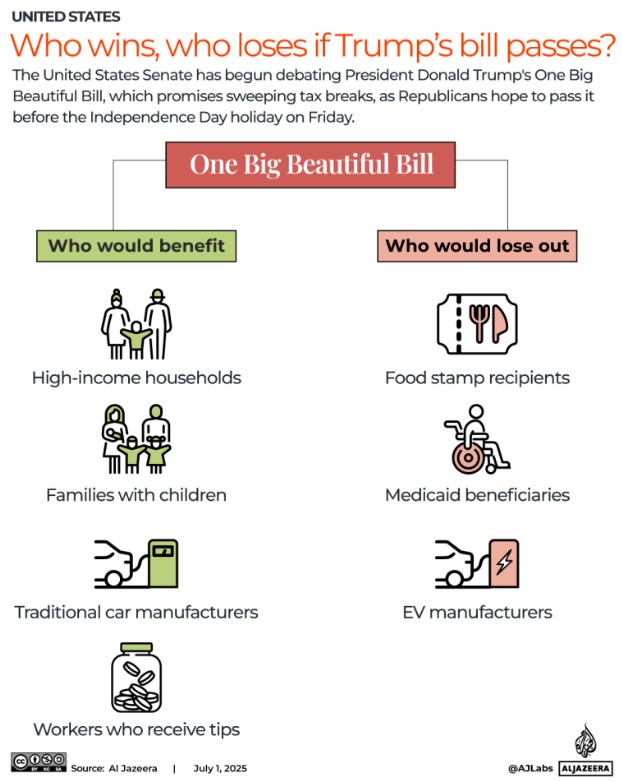

President Donald Trump has lauded the recently passed legislation as a “big, beautiful bill”, a historic piece of economic reform that he believes will stand among the most successful laws in U.S. history. Building on the foundation laid by the 2017 Tax Cuts and Jobs Act (TCJA), the bill introduces sweeping changes to taxation, business incentives, and social welfare programs. But as with any major economic overhaul, the bill creates winners and losers. While corporate giants and high-income earners are poised to benefit significantly, low-income Americans and some critical sectors could find themselves on the losing end.

This article offers a comprehensive analysis of who stands to gain, who stands to lose, and what this legislation means for the future of American economic policy.

Winners: Who Stands to Gain

1. Corporate America

Corporate America is perhaps the most enthusiastic supporter of the bill. Business organizations such as the U.S. Chamber of Commerce and the Business Roundtable have publicly applauded the legislation. At the core of their celebration are permanent tax breaks that favor large enterprises.

The bill restores a key provision from the TCJA: allowing businesses to fully write off equipment costs in the same year they are purchased. This incentive, which had been phasing out since 2023, is now back in full force, making capital investments significantly more attractive.

Moreover, companies are once again allowed to deduct research and development (R&D) costs in the year they are incurred, reversing the 2022 rule that required spreading those deductions over five years. This change is expected to encourage innovation and technical advancement, especially in the tech and pharmaceutical industries.

2. Manufacturers and Semiconductor Firms

Manufacturers are celebrating specific tax benefits tailored to boost domestic production. Businesses can now fully and immediately deduct the cost of building new manufacturing facilities. This provision, retroactive to January 19, 2025, will remain in effect for construction projects that begin before January 1, 2029.

Additionally, in a strategic move to strengthen U.S. dominance in semiconductor production, the bill enhances tax credits for chipmaking companies that build manufacturing plants in the U.S. This aligns with broader efforts to reduce dependency on foreign technology and bolster national security through tech sovereignty.

3. Small Businesses and Partnerships

Small businesses and partnerships are not left behind. The legislation makes permanent a key provision allowing owners of certain pass-through entities to deduct a portion of their income. This provision primarily benefits small business owners, including professionals like doctors, lawyers, and consultants who report business income on their individual tax returns.

The House version of the bill increases the deduction from 20% to 23%, although the Senate retained the 20% rate. Regardless, this permanent deduction brings significant tax relief to millions of entrepreneurs and sole proprietors.

4. High-Income Americans

The top earners in the country are among the biggest financial beneficiaries of the legislation. According to an analysis by the Penn Wharton Budget Model, households in the top 20% income bracket will see an average annual increase of nearly $13,000 in after-tax income, a 3% gain.

For the ultra-wealthy, specifically the top 0.1% of earners, the average annual income increase exceeds $290,000.

Additionally, taxpayers in high-tax states will benefit from a temporary increase in the cap on state and local tax (SALT) deductions. Households earning up to $500,000 can now deduct up to $40,000 annually for five years, a significant shift from the previous $10,000 cap.

However, not all provisions favor the wealthy. The bill introduces a new rule barring millionaires who lose their jobs from claiming unemployment benefits.

5. Tipped and Overtime Workers

Certain workers earning tips or overtime pay will enjoy limited tax relief through 2028. Employees in traditionally tipped roles, such as restaurant servers, bartenders, and hotel staff, can deduct up to $25,000 in tip income from federal taxes. Meanwhile, workers receiving overtime pay can deduct up to $12,500 of that income.

These deductions are subject to income caps, ensuring the benefits are targeted at middle- and lower-middle-income workers. Still, this measure is a rare nod to labor in a bill largely focused on business and high-income households.

Losers: Who Will Be Left Behind

1. Low-Income Americans

The biggest cuts come at the expense of the social safety net, particularly Medicaid and food assistance programs. For the first time in its 60-year history, Medicaid will require recipients to meet federal work mandates to qualify. Similarly, the Supplemental Nutrition Assistance Program (SNAP) will see expanded work requirements, including for parents of children aged 14 and older.

The Congressional Budget Office (CBO) estimates that millions will lose their benefits under these new conditions. Penn Wharton’s analysis finds that individuals earning less than $18,000 annually will see their after-tax, after-transfer income decline by $165 per year, a 1.1% decrease.

Those earning between $18,000 and $53,000 might experience a marginal increase, only about $30 annually, or 0.1%. By contrast, middle-income earners ($53,000–$96,000) will gain about $1,430 (1.8%).

The cuts may result in a sharp rise in uninsured Americans. Without Medicaid and employer-sponsored insurance, many will be left with few options for affordable care.

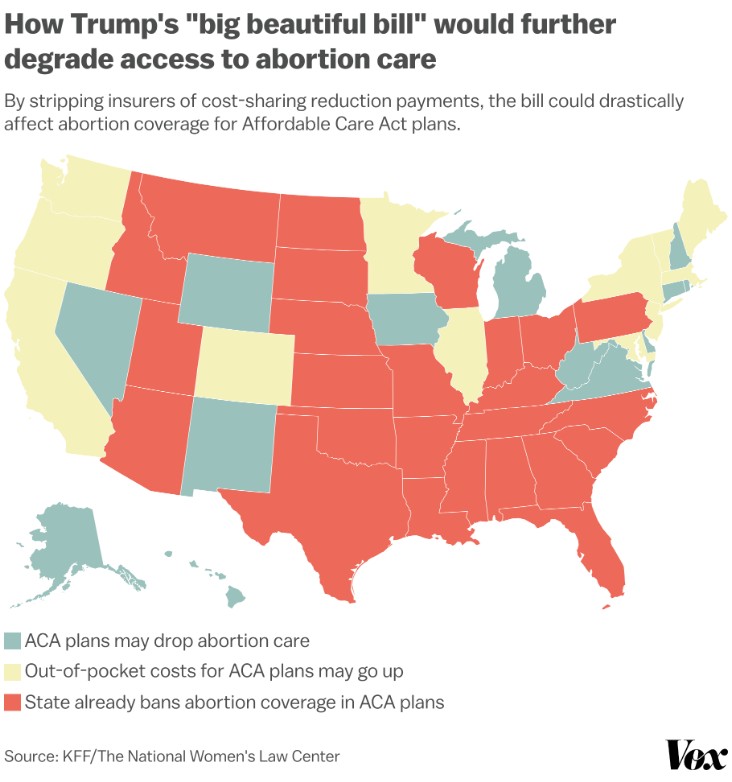

2. The Uninsured and Middle-Class ACA Recipients

Beyond Medicaid cuts, the bill also tightens verification requirements for Affordable Care Act (ACA) premium subsidies. These stricter eligibility rules could disqualify many middle-income Americans from receiving federal aid, increasing the number of uninsured households.

According to CNN’s analysis of the bill combined with CBO projections, the number of uninsured individuals could rise by more than 10 million by 2034.

3. Hospitals and Health Systems

The American Hospital Association has sharply criticized the bill, particularly its nearly $1 trillion in Medicaid cuts. Hospitals warn of a growing burden of uncompensated care as more patients lose insurance.

Rick Pollack, CEO of the American Hospital Association, said the cuts will “result in irreparable harm to our health care system.” Although the bill includes a $50 billion fund to support rural hospitals, industry leaders argue it’s insufficient to offset the massive losses.

4. Clean Energy and Renewable Projects

Although the Senate removed a last-minute excise tax on wind and solar projects, the overall outlook for the clean energy sector is grim. By 2027, tax incentives for renewable energy will be phased out. Developers will also face stricter qualification criteria.

The American Clean Power Association has condemned the bill as “a step backward for American energy policy,” warning that it will cost jobs, halt green infrastructure growth, and increase consumer electric bills.

5. Electric Vehicle Industry

Electric vehicle (EV) manufacturers also stand to lose significantly. The GOP-led bill ends the $7,500 EV tax credit on September 30, years ahead of the original 2032 expiration date.

This abrupt cut removes a powerful financial incentive for car buyers and could stall EV adoption, hurting both automakers and climate goals.

6. Deficit Hawks and Long-Term Economic Stability

Despite Republican emphasis on fiscal discipline, the legislation is projected to increase the federal deficit by $3.4 trillion over the next decade. Rising deficits may push interest rates higher, affecting everything from mortgage rates to business loans.

More worryingly, the CBO projects that the federal government will spend more than $1 trillion annually just on interest payments, more than the entire U.S. defense budget. This growing financial burden could constrain future policy choices and economic flexibility.

Trump’s “big, beautiful bill” is undeniably transformative. Its sweeping tax reforms and spending cuts create sharp divisions across income levels and industries. While corporations, manufacturers, and wealthy households reap substantial gains, the legislation puts low-income Americans, hospitals, clean energy developers, and fiscal conservatives on uncertain footing.

Whether the bill delivers long-term prosperity or deepens inequality remains to be seen. But one thing is clear: its legacy will depend not only on economic indicators but on the human stories behind the data and how America chooses to respond.

Daily Hot News -Aces vs Fever and Following Commissioner’s Cup Victory

Mello Buckzz Video and Tragedy at the Mixtape Release

Michael Madsen and Remembered After His Passing at 67

Diogo Jota Car Accident Video and Brother André Silva

Ohemaa Dynamite Sisterhood Video and Controversy Behind

Ari Fletcher Video Goes Viral on Twitter and Footage

Raul Valle Fight Video and the Trial of Raul Valle